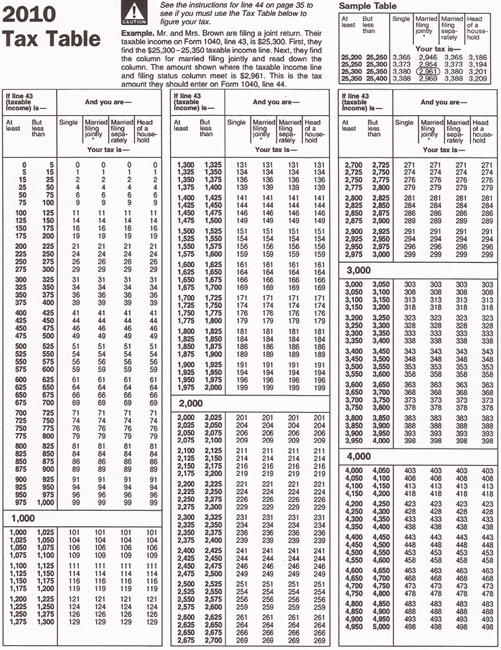

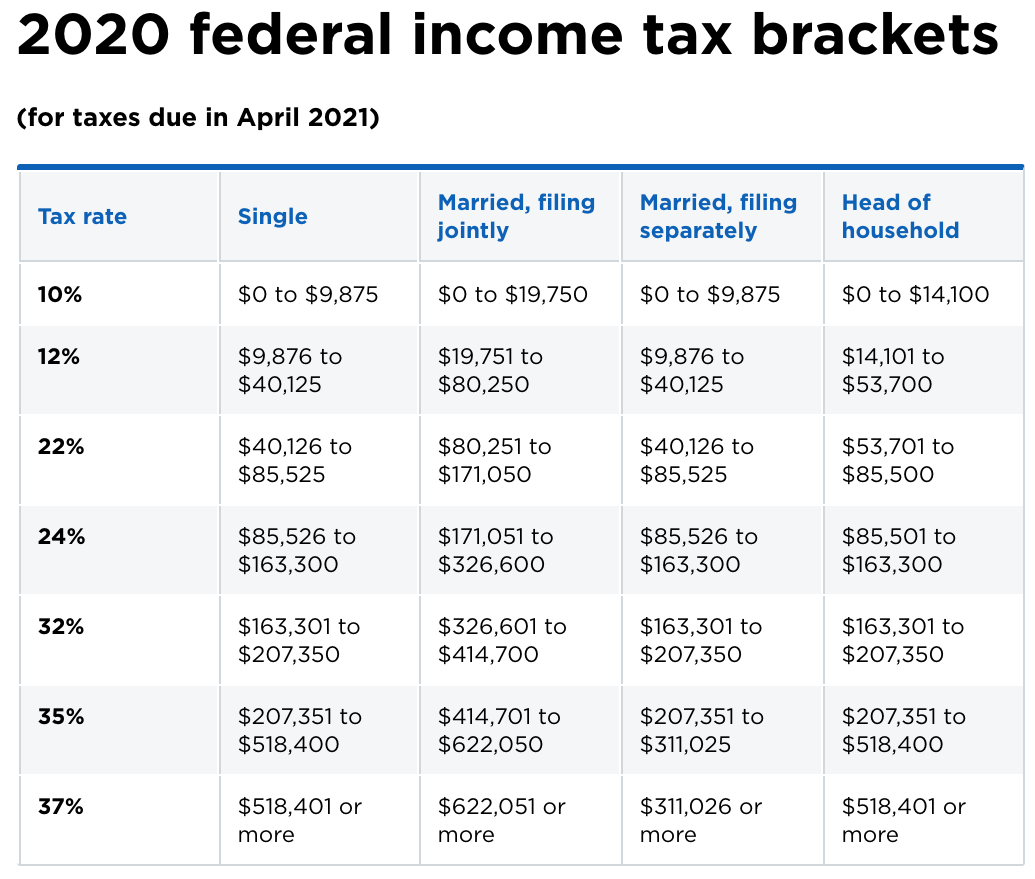

Federal Income Tax Chart

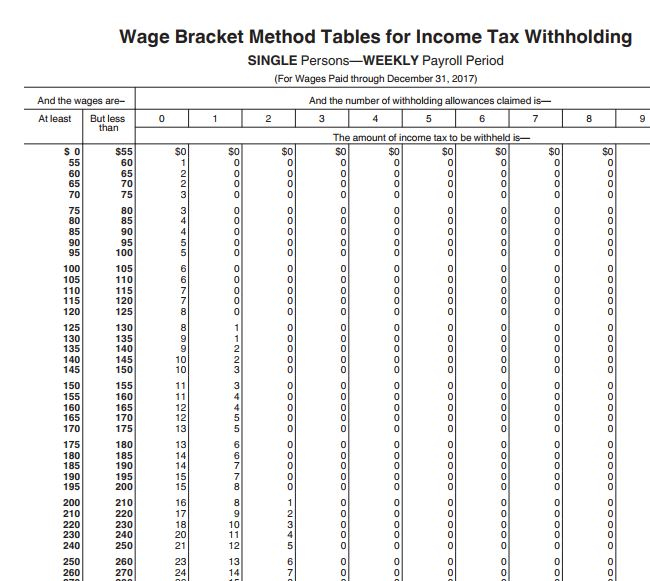

Federal Income Tax Chart. Next, they find the column for married filing jointly and read down the column. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn.

Federal Tax Tables Below are the tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator.

The calculator will calculate tax on your taxable income only.

Where Can I Find the Tax Withholding Charts? A federal tax withholding table is a chart that helps employers figure out how much income to withhold from their employees. Does not include income credits or additional taxes.

Rating: 100% based on 788 ratings. 5 user reviews.

Lloyd George

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Federal Income Tax Chart"

Post a Comment